Shelter-In-Place Offers Opportunity for Reflection: What makes us happiest? Our quarantines and shelter-in-place this year have been difficult for many,…

Read More

Retirement

IRA Limits and Deadlines — for 2019 and 2020

The deadline is approaching! July 15 is the new April 15 for the 2019 tax year, because of COVID19. The…

Read More

Five-Year Rule for Roth IRAs

The Roth IRA Five-Year Rule The Roth “five-year rule” – often misunderstood – in part governs when you can take…

Read More

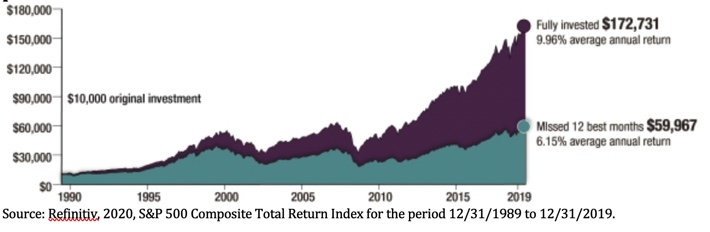

Investing: Strategy vs. Reaction

You can always count on market swings to challenge your patience as an investor, but these current swings – and…

Read More

Key Benefits of the CARES Act

…and a Note About Financial Literacy Financial Literacy for the Pandemic **NOTE: Our “Financial Literacy for the Pandemic” Zoom calls,…

Read More

2020 Retirement Plan Numbers

Thresholds and maximums for retirement contributions and deductions The government left some retirement numbers unchanged and increased some for 2020….

Read More